Surefire Price supplies both branch areas and on the internet accessibility to customers who want to make an application for a mortgage Its paperless application procedure allows customers to send paperwork electronically in addition to use and also keep track of the application procedure online. Mr. Cooper supplies clients an enhanced digital experience once the lending is safeguarded, particularly with its consumer control panel. Its Home Knowledge mobile application aids consumers take care of not just a mortgage yet their more comprehensive financial wellness.

Conventional loans backed by Fannie Mae as well as Freddie Mac, federal government entities that get home loans on the secondary market, call for a minimum score of 620. FHA loans need a minimum of 500, with at the very least 580 required if you wish to take down the most affordable down payment of 3.5%. Nonetheless, the rates of interest isn't the only aspect you need to think about when comparing home mortgage loan providers. The charges each lender fees can differ just as much as the rates of interest. So the offer with the most affordable price may not be the best offer if you're paying extreme upfront charges. To compare rates as well as costs, have a look at the Finance Price quote form that loan providers are required to offer within 3 business days of obtaining your application.

- In BC, land transfer tax obligation is based on the expense of the residential property, with a low tax obligation rate that enhances with the purchase cost.

- Usually, 15-year mortgages have lower rates but larger monthly settlements than the extra preferred 30-year home mortgage.

- The Bank has actually elevated the rate of obtaining four times in a row given that December 2021, so that the UK's main interest rate now stands at 1%, with more rises anticipated through 2022.

- Bankrate complies with a strict editorial policy, so you can trust that we're placing your passions first.

LoanDepot supplies the distinctive benefit of waiving refinance fees and also compensating assessment costs for all future refinances after your very first refinance with loanDepot. Mortgages are secured car loans that make use of the value of the residence you're acquiring as security. The drawback of a mortgage is if you're not able to make your monthly repayments, the loan provider can confiscate the home. LendingTree allows you contrast home loan products from over 1,500 lending institutions. Take a look at Expert's daily home loan price updates to see the ordinary mortgage rates for different term lengths.

This is so that your brand-new lending institution knows exactly how big your home mortgage is in relation to https://mjg2ntlin2.de.tl/5-Finest-Home-Loan-Lending-Institutions-For-Negative-Credit-Rating-Of-Might-2022.htm the value of your home as well as consequently just how much equity you have. The cost will be around EUR150 as well as the lender you're looking to change to will offer you the name of an accepted valuer to make use of. So whether you're a first-time customer, home moving company or wanting to change home loan, we'll take the hard work out of locating the very best home mortgage bargain for you. Our brand-new mortgage service, backed by our team of financial consultants, indicates you can now deal with bonkers.ie throughout your whole home loan trip.

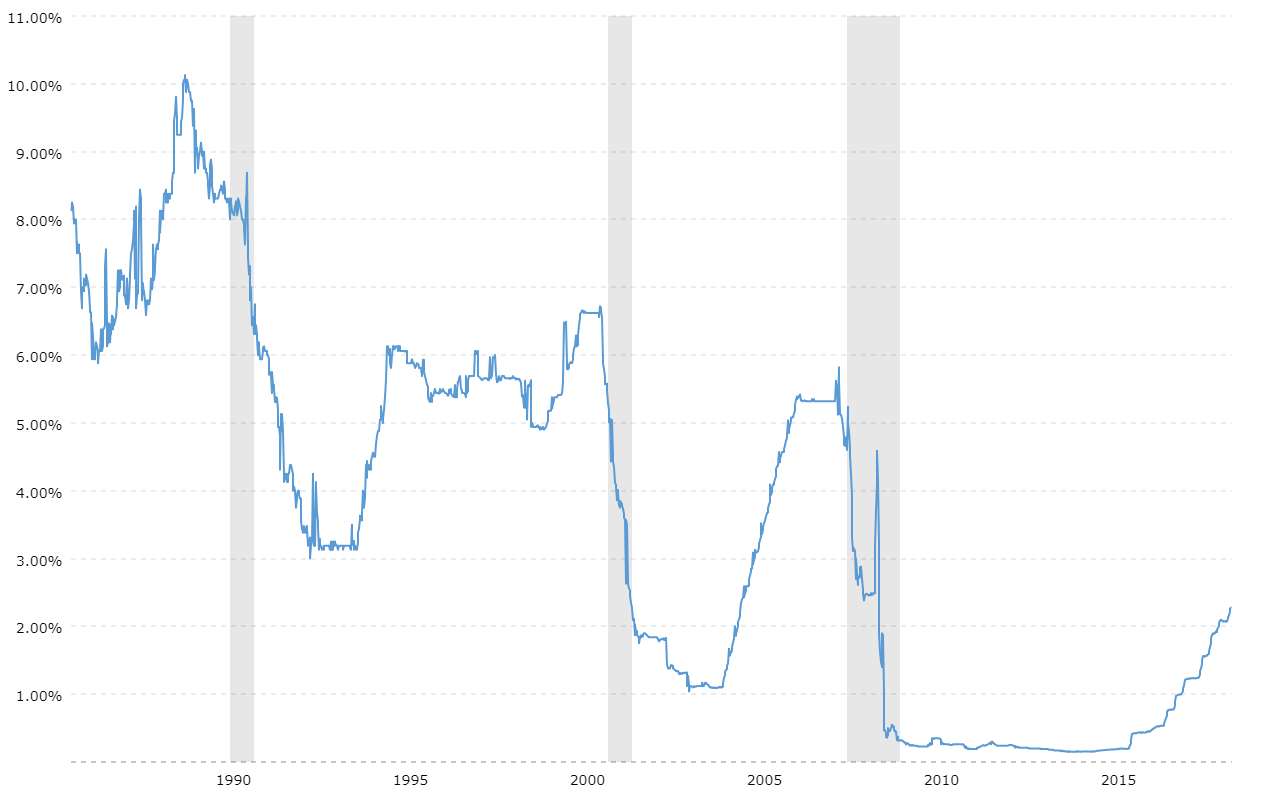

Canada Rate Of Interest From 1951 To 2022

So locating the appropriate lending institution and also getting the best deal can save you thousands of dollars over the life of the lending. Based upon a mix of results from our 2021 client fulfillment study as well as expert mortgage analysis, we've called the complying with loan providers Which? Recommended Companies - implying they're presently the most effective home mortgage lending institutions around. Every year, we survey countless home loan customers to reveal the lending institutions blazing a trail in customer support.

Borrowers have to have a minimum credit score of 620 or higher for standard as well as VA fundings. Ally provides fixed- as well as adjustable-rate conventional as well as big home mortgages and HomeReady Loans. Flagstar Bank has home mortgage items with minimal credit report demands of 620. The DreaMaker home loan, a low deposit option with versatile credit report as well as revenue needs, is tailored toward purchasers on a spending plan who might have lower credit rating. Eligible DreaMaker borrowers might also get $500 after finishing a homebuying education and learning training course.

Fixed

Editorial content from NextAdvisor is different from TIME editorial web content as well as is produced by a different team of authors and also editors. Both of those can help safeguard your financial investment in the long run. When all the information are figured out, it's time to reach the closing table, sign all the documentation as well as obtain the secrets.

Our marketers do not compensate us for desirable testimonials or recommendations. Our site has comprehensive cost-free listings as well as details for a selection of financial services from home mortgages to banking to insurance, however we don't consist of every product in the marketplace. In addition, though we make every effort to make our listings as current as possible, get in touch with the private suppliers for the current information. Based upon this method, the most effective home mortgage lending institutions normally have a Bankrate Rating of 4.9 celebrities or higher.

Unless you have certain worries, a 5-year term usually works well. Longer terms will have greater home loan rates, which can be negative for those having a hard time to pass the home loan stress test as you may be tested at a higher home loan rate. This is a specifically substantial concern for buyers in Toronto's housing market or in Vancouver's real estate market. However, you will not need to bother with requalifying for a home mortgage as often as a brief home loan term. Each loan provider will certainly supply various choices for term size and rates; call your lending institution or broker for even more details.

The quantity you pay monthly may change because of adjustments in property tax and insurance policy prices, but also for one of the most part, fixed-rate mortgages use you a very foreseeable monthly payment. You can get a home with as low as 3% down on a conventional home loan. You'll additionally require a minimal credit history of at the very least 620 to receive a traditional finance. You can miss buying exclusive home loan insurance coverage if you have a deposit of at the very least 20%.