Throughout the earlier years, a higher part of your payment approaches interest. As time goes on, more of your payment approaches paying for the balance of your loan. The deposit is the money you pay in advance to purchase a house. In many cases, you have to put money down to get a home mortgage.

For example, conventional loans need as https://griffinsdmf223.skyrock.com/3339844286-Excitement-About-Why-Is-There-A-Tax-On-Mortgages-In-Florida.html low as 3% down, however you'll need to pay a month-to-month charge (known as private home mortgage insurance) to compensate for the little deposit. On the other hand, if you put 20% down, you 'd likely get a better rates of interest, and you would not have to spend for private home loan insurance.

Part of owning a house is spending for home taxes and house owners insurance coverage. To make it simple for you, lenders established an escrow account to pay these expenditures (how to compare mortgages excel with pmi and taxes). Your escrow account is managed by your lending institution and functions kind of like a bank account. No one makes interest on the funds held there, however the account is used to Discover more collect money so your lending institution can send out payments for your taxes and insurance coverage on your behalf.

The Greatest Guide To How Did Mortgages Cause The Economic Crisis

Not all home loans include an escrow account. If your loan doesn't have one, you need to pay your real estate tax and house owners insurance coverage bills yourself. Nevertheless, the majority of loan providers provide this option because it permits them to ensure the home tax and insurance coverage costs earn money. If your down payment is less than 20%, an escrow account is required.

Keep in mind that the quantity of cash you need in your escrow account depends on just how much your insurance coverage and real estate tax are each year. And given that these expenditures might alter year to year, your escrow payment will change, too. That implies your regular monthly mortgage payment might increase or decrease.

There are 2 kinds of mortgage rate of interest: repaired rates and adjustable rates. Fixed rates of interest remain the very same for the entire length of your home loan. If you have a 30-year fixed-rate loan with a 4% rate of interest, you'll pay 4% interest up until you pay off or re-finance your loan.

The Only Guide to What Does It Mean When People Say They Have Muliple Mortgages On A House

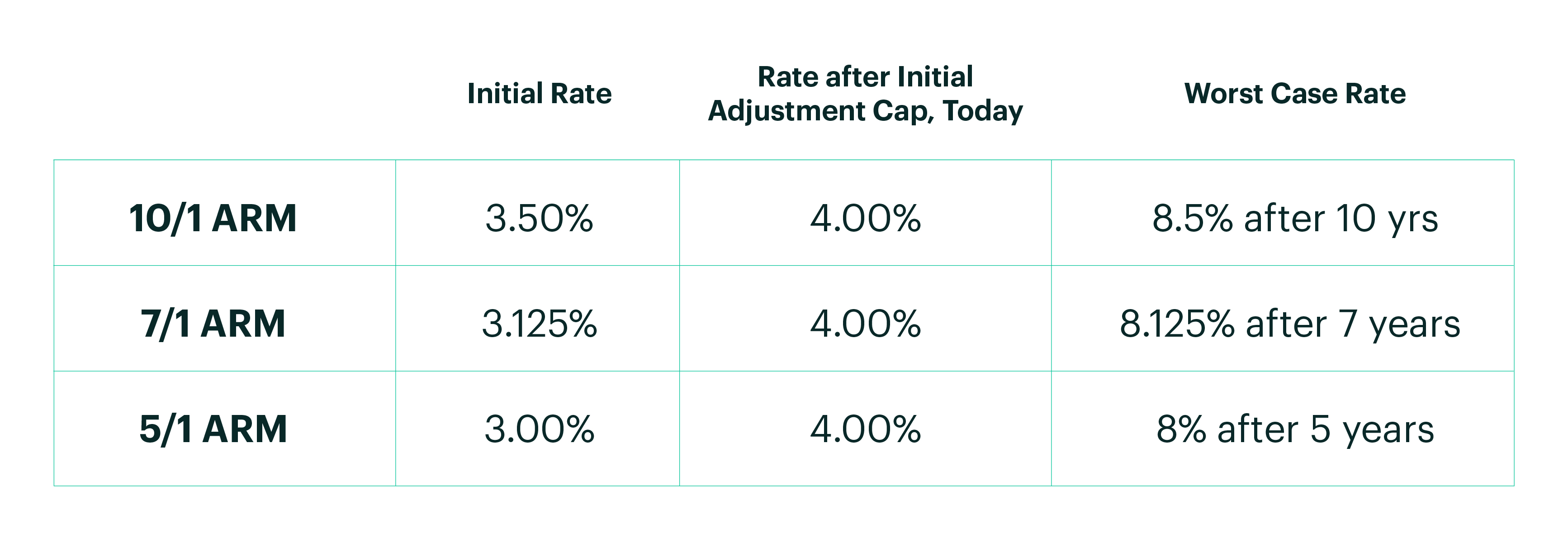

Adjustable rates are rates of interest that change based on the marketplace. Many adjustable rate mortgages start with a set rate of interest period, which generally lasts 5, 7 or 10 years. During this time, your interest rate stays the very same. After your set interest rate period ends, your interest rate changes up or down once annually, according to the marketplace.

ARMs are best for some customers. If you prepare to move or refinance prior to the end of your fixed-rate duration, an adjustable rate home loan can give you access to lower rate of interest than you 'd normally find with a fixed-rate loan. The loan servicer is the company that supervises of supplying monthly mortgage declarations, processing payments, handling your escrow account and reacting to your queries.

Lenders might sell the maintenance rights of your loan and you might not get to choose who services your loan. There are lots of kinds of home mortgage loans. Each includes various requirements, rates of interest and benefits. Here are a few of the most common types you might hear about when you're requesting a mortgage.

3 Easy Facts About In What Instances Is There A Million Dollar Deduction Oon Reverse Mortgages Described

You can get an FHA loan with a down payment as low as 3. 5% and a credit rating of simply 580. These loans are backed by the Federal Real Estate Administration; this means the FHA will compensate lending institutions if you default on your loan. This reduces the danger lenders are taking on by providing you the cash; this indicates loan providers can offer these loans to borrowers with lower credit rating and smaller deposits.

Conventional loans are typically also "conforming loans," which indicates they fulfill a set of requirements specified by Fannie Mae and Freddie Mac 2 government-sponsored enterprises that purchase loans from lenders so they can provide home loans to more individuals. Traditional loans are a popular choice for purchasers. You can get a standard loan with as low as 3% down.

This adds to your month-to-month expenses but permits you to enter a new home sooner. USDA loans are only for homes in qualified backwoods (although many homes in the suburban areas certify as "rural" according to the USDA's meaning.). To get a USDA loan, your household income can't go beyond 115% of the area average earnings.

The Only Guide to How A Simple Loan Works For Mortgages

For some, the warranty costs required by the USDA program expense less than the FHA mortgage insurance coverage premium. VA loans are for active-duty military members and veterans. Backed by the Department of Veterans Affairs, VA loans are a benefit of service for those who've served our nation. VA loans are a fantastic choice due to the fact that they let you purchase a house with 0% down and no private home loan insurance.

Each regular monthly payment has four huge parts: principal, interest, taxes and insurance coverage. Your loan principal is the quantity of money you have actually left to pay on the loan. For instance, if you obtain $200,000 to buy a home and you settle $10,000, your principal is $190,000. Part of your regular monthly mortgage payment will automatically go toward paying down your principal.

The interest you pay monthly is based upon your interest rate and loan principal. The money you pay for interest goes straight to your mortgage provider. As your loan matures, you pay less in interest as your principal declines. If your loan has an escrow account, your month-to-month mortgage payment might likewise include payments for property taxes and house owners insurance coverage.

The smart Trick of What Are Brea Loans In Mortgages That Nobody is Discussing

Then, when your taxes or insurance premiums are due, your lender will pay those costs for you. Your home mortgage term describes how long you'll make payments on your home loan. The 2 most typical terms are thirty years and 15 years. A longer term usually suggests lower regular monthly payments. A shorter term generally means larger monthly payments but huge interest cost savings.

Most of the times, you'll require to pay PMI if your deposit is less than 20%. The cost of PMI can be included to your month-to-month home loan payment, covered by means of a one-time upfront payment at closing or a mix of both. There's likewise a lender-paid PMI, in which you pay a slightly higher rates of interest on the home mortgage instead of paying the monthly fee.

It is the composed guarantee or contract to repay the loan using the agreed-upon terms. These terms consist of: Rate of interest type (adjustable or repaired) Rates of interest percentage Quantity of time to repay the loan (loan term) Amount obtained to be repaid completely Once the loan is paid completely, the promissory note is returned to the borrower. For older debtors (generally in retirement), it may be possible to organize a mortgage where neither the primary nor interest is repaid. The interest is rolled up with the principal, increasing the debt each year. These plans are variously called reverse home mortgages, life time home loans or equity release home loans (describing home equity), depending upon the country.

3 Easy Facts About What Is The Best Rate For Mortgages Explained

Through the Federal Housing Administration, the U.S. government insures reverse home loans via a program called the HECM (House Equity Conversion Home Mortgage). Unlike standard mortgages (where the entire loan amount is generally paid out at the time of loan closing) the HECM program allows the homeowner to get funds in a range of ways: as a one time swelling amount payment; as a monthly tenure payment which continues until the debtor dies or vacates the home permanently; as a regular monthly payment over a defined time period; or as a credit line.

In the U.S. a partial amortization or balloon loan is one where the amount of monthly payments due are calculated (amortized) over a particular term, however the outstanding balance on the principal is due at some time except that term. In the UK, a partial repayment home loan is rather common, particularly where the initial home loan was investment-backed.

Balloon payment home mortgages have only partial amortization, implying that quantity of month-to-month payments due are calculated (amortized) over a particular term, but the outstanding primary balance is due at some time except that term, and at the end of the term a balloon payment is due. When rates of interest are high relative to the rate on an existing seller's loan, the buyer can consider presuming the seller's mortgage.

An Unbiased View of Bonds Payment Orders, Mortgages And Other Debt Instruments Which Market Its

A biweekly home mortgage has payments made every two weeks rather of month-to-month. Budget plan loans include taxes and insurance in the home mortgage payment; plan loans include the costs of home furnishings and other individual home to the home loan. Buydown home mortgages allow the seller or lending institution to pay something comparable to points to decrease interest rate and motivate purchasers.

Shared appreciation mortgages are a type of equity release. In the United States, foreign nationals due to their unique circumstance face Foreign National home loan conditions. Flexible home loans enable more freedom by the customer to avoid payments or prepay. Offset home mortgages enable deposits to be counted against the mortgage. In the UK there is likewise the endowment mortgage where the borrowers pay interest while the principal is paid with a life insurance policy.

Involvement home mortgages enable multiple financiers to share in a loan. Home builders might take out blanket loans which cover a number of residential or commercial properties at the same time. Swing loan might be used as short-lived financing pending a longer-term loan. Difficult cash loans provide financing in exchange for the mortgaging of real estate security. In many jurisdictions, a loan provider may foreclose the mortgaged home if certain conditions occur mainly, non-payment of the mortgage.

The Ultimate Guide To What Is A Large Deposit In Mortgages

Any amounts received from the sale (web of expenses) are applied to the original financial obligation. In some jurisdictions, home mortgage loans are non-recourse loans: if the funds recovered from sale of the mortgaged residential or commercial property are insufficient to cover the impressive debt, the loan provider may not draw on the customer after foreclosure.

In practically all jurisdictions, specific treatments for foreclosure and sale of the mortgaged residential or commercial property use, and may be tightly controlled by the relevant federal government. There are stringent or judicial foreclosures and non-judicial foreclosures, also called power of sale foreclosures - blank have criminal content when hacking regarding mortgages. In some jurisdictions, foreclosure and sale can occur rather rapidly, while in others, foreclosure may take lots of months or even years.

A research study provided by the UN Economic Commission for Europe compared German, US, and Danish home mortgage systems. The German Bausparkassen have reported nominal interest rates of roughly 6 percent per year in the last 40 years (since 2004). German Bausparkassen (cost savings and loans associations) are not identical with banks that provide home mortgages.

The Ultimate Guide To Blank Have Criminal Content When Hacking Regarding Mortgages

5 percent of the loan amount). However, in the United States, the average rate of interest for fixed-rate home loans in the real estate market began in the 10s and twenties in the 1980s and have (since 2004) reached about 6 per cent per annum. Nevertheless, gross loaning expenses are substantially greater than the nominal rates of interest and amounted for the last thirty years to 10.

In Denmark, comparable to the United States home loan market, rate of interest have fallen to 6 per cent per year. A risk and administration fee amounts to 0. 5 per cent of the outstanding debt. In addition, an acquisition charge is charged which amounts to one percent of the principal.

The federal government produced several programs, or federal government sponsored entities, to foster mortgage lending, building and construction and encourage home ownership. These programs consist of the Federal government National Mortgage Association (understood as Ginnie Mae), the Federal National Home Loan hilton grand vacations timeshare presentation Association (called Fannie Mae) and the Federal House Loan Home Mortgage Corporation (called Freddie Mac).

Some Of How Is The Compounding Period On Most Mortgages Calculated

Unsound loaning practices resulted in the National Mortgage Crisis of the 1930s, the savings and loan crisis of the 1980s and 1990s and the subprime home mortgage crisis of 2007 which resulted in the 2010 foreclosure crisis. In the United States, the home mortgage loan includes 2 different files: the home mortgage note (a promissory note) and the security interest evidenced by the "home loan" document; normally, the 2 are assigned together, but if they are split traditionally the holder of the note and not the home mortgage can foreclose.

In Canada, the Canada Mortgage and Housing Corporation (CMHC) is the nation's nationwide real estate company, supplying home loan insurance coverage, mortgage-backed securities, real estate policy and programs, and real estate research study to Canadians. It was produced by the federal government in 1946 to attend to the country's post-war real estate lack, and to assist Canadians accomplish their homeownership goals.

where the most typical type is the 30-year fixed-rate open home loan. Throughout the monetary crisis and the occurring economic downturn, Canada's home loan market continued to work well, partially due to the domestic mortgage market's policy framework, that includes an efficient regulative and supervisory program that applies to many lenders. Because the crisis, however, the low rate of interest environment that has actually occurred has added to a considerable increase in mortgage debt in the nation. what happened to cashcall mortgage's no closing cost mortgages.

Examine This Report about What Is A Non Recourse State For Mortgages

In a declaration, the OSFI has actually specified that the standard will "supply clarity about finest practices in respect of residential mortgage insurance underwriting, which add to a steady financial system." This follows several years of federal government scrutiny over the CMHC, with previous Finance Minister Jim Flaherty musing publicly as far back as 2012 about privatizing the Crown corporation.